Despite a track record of financing linked to land grabbing and deforestation, agricultural investment funds, or Fiagros, have been cleared by Brazil’s Monetary Council to receive up to 10% of pension fund assets

When Brazil’s military dictator Ernesto Geisel signed Federal Law No. 6,435/1977, which formalized the regulation of private pension funds in Brazil, some companies were already offering employees supplementary retirement benefits.

In his time in power, Geisel planted one boot in the pension funds and the other in the push for technological investment in agribusiness. His administration’s programs encouraged transforming native Cerrado vegetation into export-oriented soybean fields thanks to major capital incentives.

Forty-eight years later, the National Monetary Council (CMN) has combined two of Geisel’s key priorities under a single regulation. CMN Resolution 5,202/2025 makes Fiagros—investment funds channeling money into Brazil’s agribusiness sector—eligible assets for the country’s Closed Supplementary Pension Entities (EFPCs), or pension funds.

Previously, pension funds were not barred from investing in Fiagros or other agribusiness vehicles, but the new regulation formally adds Fiagros to EFPC rules—grouping them with other agricultural investments as a single asset class. The resolution caps allocations at 10% of a fund’s assets, a limit that could increase.

“We’ll respect that limit. If the market grows and the risk-return balance remains favorable, we’ll raise the cap,” says Alcinei Cardoso Rodrigues, director of Standards at the National Supplementary Pension Fund Superintendence (Previc), which drafted the resolution adopted by the CMN.

Based on the total assets managed by Brazil’s 270 pension funds, Joio estimates pension funds could invest up to US$22.89 billion (130.9 billion Brazilian reals) in Fiagro shares—nearly tripling Fiagro’s current asset base.

If the three largest funds—Previ, covering Banco do Brasil employees; Petros, for Petrobras; and Funcef, for employees of state bank Caixa—invested heavily, their US$9.43 billion (53.9 billion reals) alone would more than double Fiagro investments from the past four years.

Supplementary pension funds manage vast resources, equal to 11% of Brazil’s GDP as of 2024. The anticipated increase in Fiagro investments would represent over a third of what’s allocated in the Plano Safra 2024-2025, the current federal program providing public financing for agribusiness.

Since their 2021 debut, Fiagros traded on B3—the Brazilian stock exchange—have been open to individuals investing personal savings. Now, with their explicit inclusion in pension fund regulations, large segments of the population could support agribusiness through indirect, collective investment via decisions by pension fund managers. Over 2.6 million people in Brazil participate in such funds.

“At Previc, we see huge growth potential for Fiagros. How much growth? I really have no idea,” Rodrigues, from Previc, says.

Fiagro is classed within the structured segment, meaning it combines two or more asset types serving the same purpose: supplying capital to agribusiness. Other products in this segment include equity investment funds, access markets, structured operation certificates (COEs), and multimarket funds. Pension funds can allocate up to 20% of their portfolios to assets in this structured investment category.

Alongside Fiagro, carbon and decarbonization credits have also been added to CMN’s eligible list for pension funds, with a limit of 3% of portfolio assets for these products.

Explicitly listing Fiagros among permitted pension fund assets has highlighted the complex route capital takes before reaching agribusiness firms. Billions of reals might flow to financial instruments with weak safeguards against the destruction of threatened ecosystems like the Amazon and the Cerrado.

The Fiagro investor base is also shifting. Where these funds initially attracted small, individual investors—“sardines” in Brazilian market slang—the prospect of institutional money has cast a net for “bigger fish” and a deeper agribusiness presence on the stock market.

Agriculture and carbon—once more with generic rules

Anyone, not just the million-plus participants, can search online to see how California’s massive teacher pension fund, valued at US$349.5 billion, invests its assets. For example, CalSTRS, the California State Teachers’ Retirement System, publicly lists holdings in debt securities by company, principal value, and rate of return. Their portfolio disclosures show major investments in the oil company Shell; the world’s largest investment fund, BlackRock; and the chemicals multinational, Dupont.

Similarly, Previ—the largest pension fund in Brazil, serving Banco do Brasil employees—publishes detailed allocations in its annual Social Balance Sheet. Oil companies are prominent in Previ’s assets. Some benefit plans invest in state-owned Petrobras and the Rio de Janeiro-based oil company, Prio. The fund also holds over 5% of the shares in Vibra Energia, a Petrobras subsidiary.

Yet such transparency is not the norm among supplementary pension funds in Brazil, even in a regulated market—effectively preventing real public scrutiny of investments.

That’s the case at COMSHELL Sociedade de Previdência Privada, a fund for Shell employees in Brazil, which discloses only broad investment categories (like fixed or variable income, or shares) in its reports, withholding details on underlying assets.

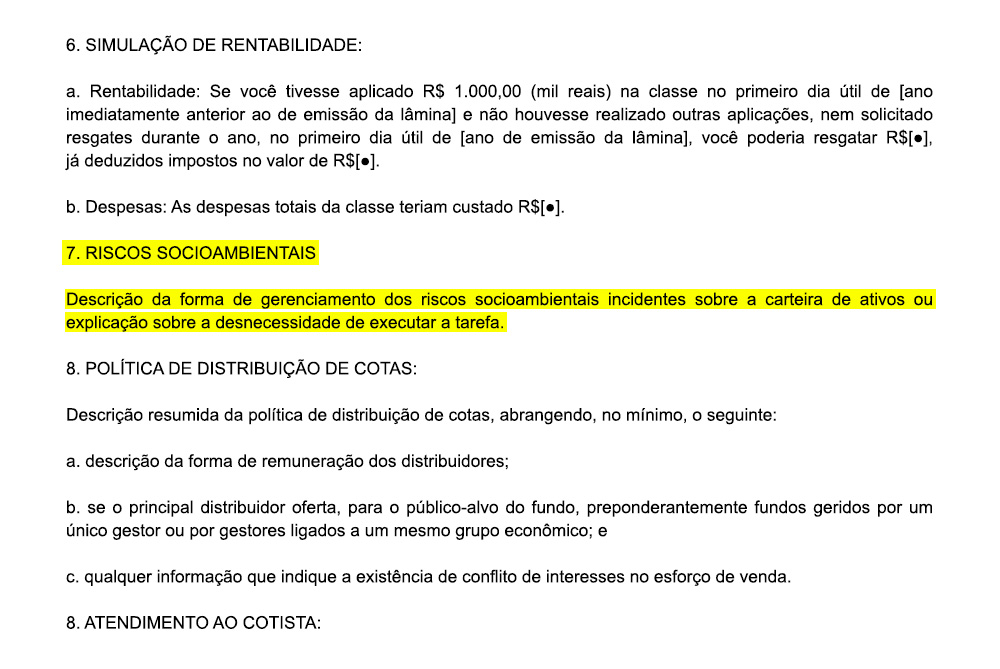

The new CMN directive, expanding eligible pension investments to Fiagros and carbon credits, modifies a 2022 regulation that hadn’t mentioned socio-environmental risks.

Now, these concerns get a brief mention, requiring pension funds to “consider aspects related to the economic, environmental, social, and governance sustainability of investments” during risk analysis, and “evaluate and provide transparency on the environmental, social, or governance impacts of the investment portfolio.”

“That’s simply not enough. What does transparency mean here? What exactly needs to be disclosed? What details must be reported, and how should risk analyses be performed?” asks Luciane Moessa, who leads technical and executive operations at the Sustainable Inclusive Solutions Association (SIS), which monitors socio-environmental rules in the capital markets.

“Ideally, you’d see sector-by-sector breakdowns, locations of funded activities, specifics on each company’s socio-environmental and climate risk, and documentation showing what due diligence informed those risk assessments”, Moessa continues.

While the CMN has avoided robust requirements for pension funds, the Securities and Exchange Commission (CVM)—Brazil’s capital market watchdog—has also largely dismissed warnings from civil society on the minimum conditions needed to keep capital away from agribusiness ventures with environmental or labor violations.

Suggested filters for rural properties linked to Fiagro assets:

• Full geolocation and/or business address within the supply chain, Rural Environmental Registry (CAR), or equivalent;

• Verification of the existence of embargoed areas and infraction notices by Ibama or state environmental authorities;

• Checks for recent deforestation using INPE data;

• Verification of licenses for vegetation clearance;

• Recognition of “rural property” as one with a certified Rural Property Registration Certificate (CCIR) and a CAR validated with a Rural Activity License (LAR) issued by the environmental agency;

• Screening for the appearance of the owner on slave labor blacklists;

• Search for occupational health and safety violation records with the Labor Ministry.

Suggested filters for companies borrowing from Fiagro:

• Screening for the appearance of the owner on slave labor blacklists;

• Search for environmental violation records with Ibama or state authorities;

• Checking for occupational health and safety infraction notices with the Labor Ministry;

• Supply chain compliance checks

Source: Public Consultation SDM 03/2023/CVM

Despite detailed proposals to prevent credit from reaching deforesters, land grabbers, and labor law violators, the CVM limited its rule to a single line mentioning environmental oversight for Fiagros.

“In reality, this gives a stamp of approval to any sort of management. Regulators should require mandatory due diligence for setting up a Fiagro, not just ask ‘tell me what you did,’” Moessa says.

This report pressed Previc, the pension fund regulator, about whether greater transparency on portfolio holdings may soon be required.

“This sort of data isn’t fully available to the public—for now, only Previc has access,” says Alcinei Rodrigues, referring to current disclosure practices. “But we hope to change that in the next regulatory cycle by imposing rules on accounting planning and mandating clear explanatory notes so this is made clear.”

From 10 reals to billions

In Fiagro’s early days, the industry relied on individual savings to get started. Observers recall the marketing pitch: mini-shares of Fiagro for up to US$1.75 (10 reals), backed by crowds of small retail investors supporting the new fund. According to agribusiness market analysts, however, this wave of individual investors will become less relevant as issuers refocus on institutional investors capable of injecting significant capital.

“Fiagro remains on the margins of the larger financial market, so letting pension funds in seems like an attempt to save the sector. There’s a major push to make it thrive,” says Cássio Arruda Boechat, professor in the Geography Department at the Federal University of Espírito Santo (UFES), who studies agricultural financialization.

Boechat notes that individuals rushed into Fiagro in its first two years, a feverish trend that cooled after the default crisis that the financial instrument faced in 2024.

Several issuers of Agribusiness Receivables Certificates (CRAs)—the core assets backing most Fiagros—missed debt payments due to bankruptcy or after deprioritizing the securities among payables. This led to a drop in monthly dividends for holders, whose returns depend on timely payments of the underlying debts. For several investors, the interest they expected from Fiagro dried up.

In an academic article written during that market turmoil, Boechat concluded that while payment defaults cause immediate turbulence for investors, accusations linking Fiagro to socio-environmental damage do not affect stock prices.

“It’s a kind of deafness—total insensitivity within the financial sector toward Brazil’s abundant social and environmental problems, many of which have played out in Fiagro’s still-brief history,” the researcher contends.

Individuals initially flocked to Fiagros for their high yields compared to other similar assets—a basic market axiom: higher risk promises higher reward, until risks materialize.

Since entering the capital markets, the number of individual Fiagro investors has fallen by 67%, while institutional investors and funds have increased their market presence by 458%.

The Parliamentary Agribusiness Front (FPA) claims to have played a central role in bringing Fiagros into the investment portfolios of organizations. Although Joio requested an interview with the FPA’s lobbying branch, Instituto Pensar Agropecuária (IPA), it received no reply. According to Previc, the FPA and IPA influenced pension fund regulations only indirectly, by shaping the general rules for Fiagros.

The funds’ dirty secrets

On the surface, a group of taxpaying professors might seem harmless. But these groups have amassed billions in resources—money that has gone on to bankroll land grabs and the forced displacement of rural populations.

One of the most famous cases of pension funds being used for these purposes is TIAA, the American teachers’ pension fund, which, together with Harvard’s endowment, was convicted in court for illegally acquiring 202 hectares of public land in the Cerrado.

The foundations’ holdings in companies associated with deforestation and land grabs led to the launch of the TIAA Divest! campaign, urging the US pension heavyweight to pull back from climate-damaging investments. Nationally, the administration of Brazil’s multibillion-real pension systems has long fostered corruption. Between 2016 and 2018, at least four federal investigations—Greenfield, Recomeço, Pausare, and Rizoma—targeted abuses in pension finances. Flagship funds like Postalis, for postal workers; Petros; Previ and Funcef have all been implicated in scandals involving sweetheart contracts and kickback schemes underwritten with their members’ savings.