On discussing tax on cigarettes, BAT Brasil and Philip Morris move in opposite directions. Why?

If we think about the tobacco industry, we can imagine a homogeneous block, with big companies united around the same interests. In reality, however, it’s a bit more complicated than that. Of course, industry leaders do have a lot in common: they want to circumvent tobacco control programs, maximize their profits and convey an image of social responsibility. It so happens that these companies compete with each other, and when it comes to lobbying for certain agendas, they may take opposing positions.

One such agenda is cigarette taxation. In 2019, the then minister of Justice and Public Security Sergio Moro created a Working Group (WG) to evaluate the reduction in tax on cigarettes manufactured in this country. The WG was to see, among other things, if this would help to reduce smuggling (we have told the story of this Group here).

The two largest companies in the sector immediately took a stand. BAT Brasil (formerly Souza Cruz) said it supported “both the creation of task forces to combat smuggling, and a review of the current tax model applied to cigarettes in Brazil”. Philip Morris, on the other hand, stated that the fight against smuggling “should not involve alternatives that could result in lower taxes and prices, increasing access by the lower income population to a product such as cigarettes”.

This antagonism may have sounded strange to those who do not follow closely the steps of these two companies. It even seemed that Philip Morris had all of a sudden become concerned about the increase in smoking among the population, while only BAT Brasil thought more about their own pockets than about people. But that is not quite what this was all about. Actually, the split was expected: “This does not surprise me at all”, reveals economist Roberto Iglesias, former coordinator of the Tobacco Control Economics Unit at the World Health Organization (WHO).

He says that when it comes to discussing taxes, for a long time there has actually been this difference in stance among the tobacco giants in Brazil. The reason is marketing: it has to do with the type of cigarette that each company sells, with the target audience they aim, and how much taxes affects profits on their flagship brands.

These interests will become clearer throughout this report, but they are not always obvious in the kind of arguments the companies build to support their demands.

And they could not fail to present their positions to the Ministry of Justice WG. Via the Access to Information Act (LAI), Joio obtained a series of documents related to the WG, and among them are four studies on taxation forwarded to the Group by representatives from the tobacco industry: Philip Morris, BAT Brasil, Japan Tobacco International (JTI) and the Brazilian Institute of Ethics in Competition (ETCO), of which BAT Brasil is a member.

One person who took part in the WG and spoke to Joio on the condition of anonymity said the Group did not ask the industry for any input, but the companies offered the documents anyway.

Initial talks

The idea that raising cigarette prices can reduce consumption is based on the price elasticity of demand concept, which measures consumer reaction to the price of a product.

“Let’s imagine that a person buys a tube of toothpaste every 15 days at a certain price. If the price of the toothpaste and the person’s income don’t change, they can keep on with this constant consumption. But if the price of the toothpaste increases and the income remains the same, this person has only two options: either save on other items in order to continue with the same consumption of toothpaste, or reduce the amount of toothpaste used for the tube to last longer”, illustrates Iglesias. When a population increases or reduces its consumption of a product due to price variations, it is said that demand is elastic; when it is a very essential product, with difficulties to reduce its consumption, its demand is inelastic.

Cigarettes are not essential, but they are addictive. For that reason, their demand is not very elastic, and when the price increases, demand doesn’t fall very much. But it does fall: The WHO estimates that a 10% cigarette price increase leads to an approximate 4% reduction in demand.

This is one of the reasons for increasing the tax burden on cigarettes. There is another one: even if smoking prevalence doesn’t fall that much, at least the taxes guarantee resources for governments to cover – partly – the social damage caused by tobacco.

In Brazil, the last change in legislation to increase cigarette taxes took place in 2011, and changed the IPI (Industrialized Product Tax – Imposto sobre Produtos Industrializados). Until that time there were six cigarette categories, and for each one, a fixed IPI rate. The cheaper brand categories payed less tax and the more expensive ones paid more. As of 2011, IPI was divided into two parts: one is a flat rate (currently at R$ 1.50) and the other increases according to the sale price. A minimum price per pack or box was established, which currently stands at R$ 5.00. Both IPI and minimum price have been frozen since 2016.

Popular cigarrettes

Of the four documents sent by industry representatives to the WG, the longest was the one submitted by ETCO: 123 pages of a report on the impact of cigarette smuggling on the economy, commissioned by the Institute from the Getúlio Vargas Foundation (FGV, in the Portuguese acronym).

Right at the introduction, there is an interesting point: the text says that despite the negative side of cigarette consumption, “the existence of cigarettes as a consumer product also has positive effects, both from the microeconomic (since consumer freedom of choice is an important normative value) and the macroeconomic point of view, through the generation of revenue for the State, as well as jobs and income”.

With regard to taxes, the report also states its objective right on the first pages, stating that the changes in tax policy from 2011 strengthened the illegal market. It would therefore be desirable for there to be “a review of the tax policy model, without necessarily resulting in a reduction of the total tax burden”.

The objective would be to have cheaper legal cigarettes which could compete with illegal ones. “The Working Group existed precisely to move forward, to get out of the box. And why exactly get out of the box? Because Brazilian cigarettes are highly taxed. On one hand that’s natural, taxation is part of any anti-smoking policy in the world, because cigarettes become expensive and smokers stop smoking. It so happens that in Brazil this is totally untrue. Why? Because our neighbor [Paraguay] has eight cigarette factories”, says Edson Vismona, ETCO executive director and president of the National Forum for Combating Piracy and Illegality (Fórum Nacional de Combate à Pirataria e à Ilegalidade – FNCP).

The document quotes an Ibope (now Ipec) survey indicating that the highest concentration of consumption in Brazil lies in cigarettes sold at under R$ 3.49. The report concludes that under current conditions, the “optimum price” for legal cigarettes to compete with the smuggled variety would be R$ 3.00 – unfeasible due to the tax burden. The solution, then, would be for these cigarettes to pay very little tax.

But as we have already pointed out, the document talks about reviewing the tax model without necessarily reducing the total tax burden. How would this be done? By breaking down the market into price categories, so that the more expensive the cigarettes, the higher the tax burden. The assumption is that this way the total tax burden would be maintained. So the two main suggestions are: to allow there to be very cheap legal cigarettes and the tax levy be progressive.

From the outside in

The document delivered by BAT Brasil on the other hand does not present specific data or simulations on the situation in Brazil. The company claims to have attached two studies: The economy of illegal tobacco trade in Malaysia, produced by Oxford Economics for BAT in April 2019; and Relation Between Prices and Price Elasticity on Cigarette Demand, of July 2019, commissioned from FTI Consulting. Only the latter is listed among the documentation received by Joio, but the former is available on the BAT Malaysia website.

Contrary to the study sent by ETCO, neither of these studies was produced specifically for the WG. The first report, which is about the situation in Malaysia, follows a very similar line of thought to the one used by the company in Brazil: it associates the tax increase in the country to the increase in the illegal market – and is not fundamentally based on official data sources, but on estimates by Nielsen and BAT itself. The report also claims that national cigarette production is important to the country’s economy and that due to the growth of the illegal market, two domestic factories were shut down (one belonging to BAT and one to JTI, Japan Tobacco International).

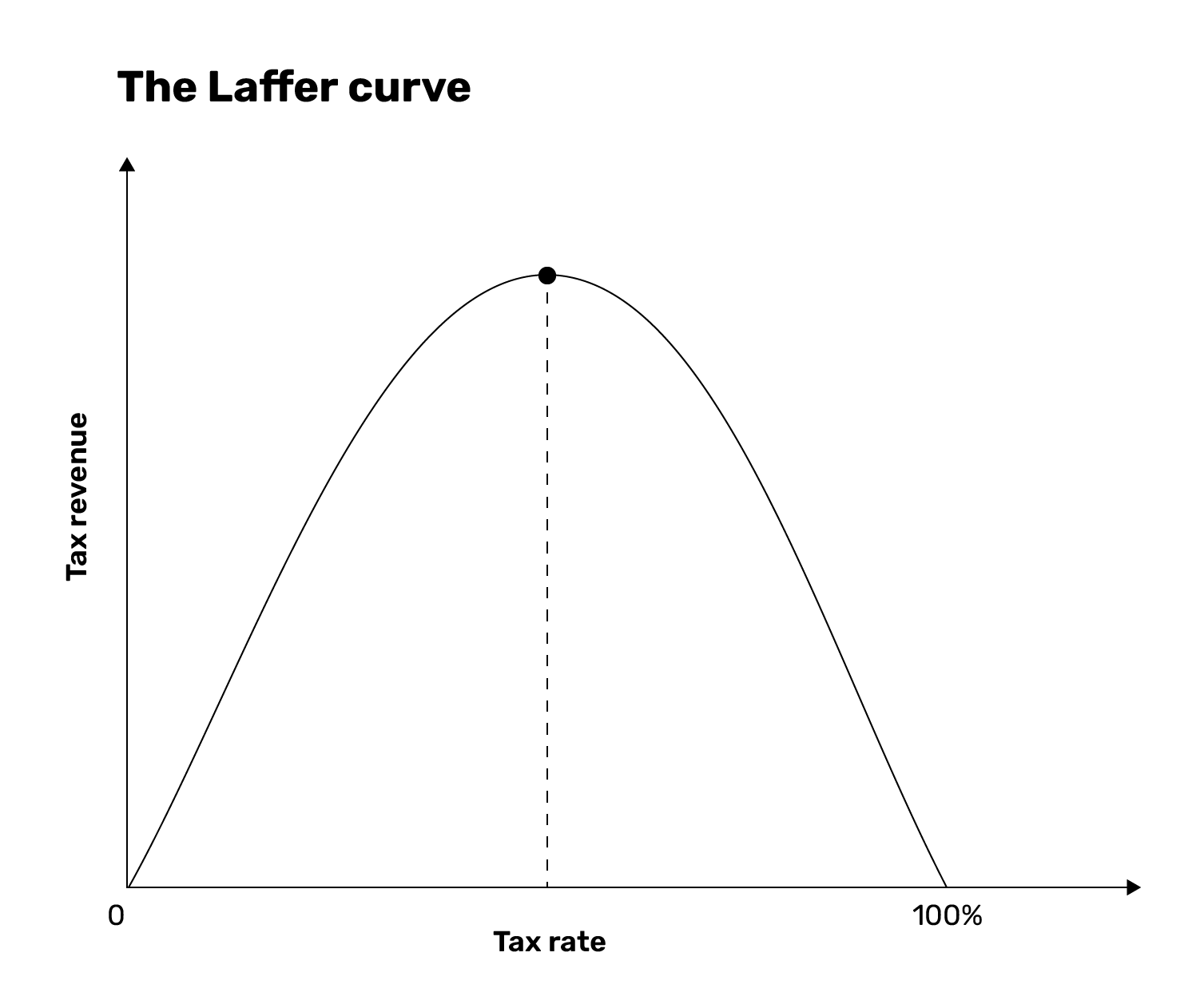

The second report estimates that cigarette pricing and tax policies in the UK had reached a tipping point. To do this, the report uses the Laffer curve model. The basic idea is that as tax on a product increases, revenue rises up to a certain point, and then starts to fall – because the population stops purchasing that product or switches to cheaper options.

The text also states that a product’s elasticity rises in tandem with price, and that since the price of legal cigarettes has risen sharply in the UK in the last few decades, demand has become elastic (i.e. it starts to fall sharply in response to changes in price). But it says that this elasticity does not increase as much when you consider total cigarette consumption – because although demand for legal cigarettes decreases, it is offset by increased demand for the illegal variety.

“There is a point to that. It’s not that those of us who work in tobacco control don’t think there might be changes in elasticity. Indeed, there are. But we need to think: why does this happen and at what magnitude?”, questions Roberto Iglesias. He agrees that when prices become too high in relation to income there is a tendency for demand to fall. But he observes that this elasticity also changes when there is increased offer in the illegal market. “In the case of Brazil, after taxes rose, there was a drop in sales of legal cigarettes until 2014 and the illegal market did not grow much. It was from 2015 on that illegal cigarette sales speeded up. There were two factors contributing to this: the country was going through a severe economic crisis – with people’s income dropping – and the supply of illegal cigarettes increased strongly”, he points out.

And why was there growth in supply? ETCO and its associate BAT Brasil place the responsibility for this growth definitively on the tax increase. “We even ran a campaign which stated this precisely: ‘Taxes go up, crime is forever grateful (imposto cresce, o crime agradece)’. Because if there is a tax increase, it increases the competitiveness of smuggled products. Smugglers see improved chances for growth, because they will continue to offer a cheap product”, says Edson Vismona.

But Iglesias sees things differently: “We must think about whether the growth in the smuggled goods market is exclusively a result of the price of legal cigarettes or if there is another factor determining this. Would the determining factor not be ‘falta de vergonha’ [total lack of shame/morals]?”, he asks, quoting a popular Brazilian expression in perfect Portuguese. And explains: “When I started to study the illegal cigarette market in Brazil, I couldn’t buy these cigarettes in Rio de Janeiro. It was very difficult, access was restricted, sales were very much on the quiet. But from 2015 and 2016 I started seeing these cigarettes everywhere. Seizures at the borders increased, that’s a fact, but there seemed to be a kind of loosening up on the control of retail distribution. Thus, whatever is able to make it past the border controls ends up being distributed very easily”.

Going against the grain

The study sent by Philip Morris was commissioned from consultancy firm RC Consultores and deals specifically with tax policies in the Brazilian cigarette market.

The authors estimate that if the minimum price of cigarettes were to fall to R$ 3.50, government revenues could fall by R$ 3.2 billion. To offset this loss, it would be necessary for the legal market to increase – dramatically – its sales volume. According to the authors, in order to recover the full amount, legal brands would need to gain 74% of the recoverable illegal market (“recoverable” meaning the share of the illegal market which is currently sold in legal outlets). But since the distribution of tax revenues between the federal government and the states is unequal, the losses would affect states more negatively. In order for them not to lose out, it would be necessary to absorb 97% of the recoverable illegal market.

The study goes on to say that “a reduction in taxes, and consequently in the final price of cigarettes in Brazil, would lead to an increase in cigarette consumption, contrary to the policies adopted effectively over the last two decades to reduce tobacco consumption in the country”.

The possibility of reducing the IPI [Industrialized Product Tax] was also addressed, eliminating the variable portion and maintaining only the flat fee. For the fixed portion or flat fee, two possibilities were considered. The first, as publicly advocated by ETCO and BAT Brasil, is to segment the market, with various fixed IPI bands depending on the price of the cigarettes – the cheaper ones paying less IPI. The study presented by Philip Morris rejects the proposal, claiming that this “radically changes the cigarette tax structure, making it progressive, which is not desirable with regard to a product on which efforts are made to reduce consumption”. Additionally, the text argues that fixing the IPI tax in bands, some lower than the rate of R$ 1.50 currently in force, would result in “considerable losses to public coffers”.

However, the authors look favorably upon the possibility of having a flat IPI rate for all cigarettes, eliminating the part which is proportional to price. They say that the idea “is welcome, insofar as it simplifies the cigarette tax structure and increases the regressive aspect of the market”.

Battle of the giants

Why, after all, do the leaders of the tobacco industry in Brazil disagree about cigarette taxes? The key to understand this, says Iglesias, lies in each company’s main brands and their target audiences.

“The main Philip Morris brand is Marlboro. In Brazil, it is a higher-end brand of cigarette for which there is always a market, because it is consumed by people on higher incomes, explains the economist. If prices were to be broken down into different categories, Marlboro would be in a higher tax bracket. “BAT, on the other hand, has a few brands that could fit into intermediate tax categories, but which could compete with Marlboro depending on how they were presented, for instance. So they could bring competition to Marlboro, but paying lower taxes and having just a slightly lower sale price”, he explains, adding that this could be the case with Kent cigarettes, which a few years ago replaced the discontinued Free brand.

According to Iglesias, Philip Morris realized very quickly that the demand by BAT Brasil for market segmentation was a competitive tactic. Similarly, Philip Morris is not interested in reducing the minimum price for cigarette packs – although the company actually has one or two cheaper brands, that is not their focus. “This is basically a battle between BAT Brasil and Philip Morris”, summarizes the economist.

This also helps to explain why, despite being against the segmentation and reduction of the minimum price, Philip Morris is in favor of a specific change: eliminating the part of the IPI tax that is proportional to the price, leaving only the flat rate. After all, it is the fixed part of the tax that makes the more expensive cigarette brands pay proportionally less tax. “They are not fools. If they could reduce their taxes, they would. What they don’t want is segmentation, because they know that in this case they would lose out”, concludes Iglesias.

Vismona maintains that he is not interested in market logic. “I don’t understand market logic nor do I know who dominates market A, B or C. I don’t know who dominates the higher or lower income public. I don’t follow that, it’s not my objective. My objective is only to combat smuggling”, he states. However, he chairs an institute which has BAT Brasil among its associates – and his standing is perfectly aligned with the market needs of that company.

When asked about this coincidence, he denies that ETCO is specifically defending BAT Brasil. “I defend Souza Cruz, I defend Philip Morris, I defend JTI. Any legal product has to be protected, unlike the illegal ones, which pay no taxes. Shall we talk about “joio e trigo” [the wheat and the chaff]? This the chaff, my role is to fight the chaff. Now, how the wheat is divided, I don’t know, that’s not my concern.”

Said and unsaid

And where does JTI stand in this story? According to Roberto Iglesias, the company is also keeping an eye out for any tax reduction because they only sell very cheap cigarettes, very close to the current minimum price. “Their main brands, Winston and Camel, are not necessarily cheap abroad, but they entered Brazil at very low prices in order to penetrate the market. To do this, however, JTI subsidized those prices, keeping profit margins small. The company wants to recover profitability without having to raise prices”, he says.

The document sent by JTI to the Working Group is very succinct: four case studies, apparently prepared by the company itself on Ecuador, Canada, Montenegro and Sweden. Fávio Goulart and João Marcelo Marins – director of corporate affairs and communications and government relations manager, respectively –, signed the letter saying that “we at Japan Tobacco International acknowledge and fully support the Ministry’s initiative to create the Working Group to objectively analyze the relationship between tobacco taxation and the growth of the illegal market”.

The text says that the four countries in question have seen the illegal cigarette trade grow after increasing their taxes, and this allegedly indicated that “tax increases on tobacco products are not effective, since they have been repeatedly undermined by the operation of the illegal market”.

But that’s just part of the story, warns Roberto Iglesias. In the case of Ecuador, for example, he says that there was indeed a reform which increased cigarette taxes in the country in the middle of the last decade. But what we have seen since then was, in his words, a “case of strategic action by the industry against the tax policy”.

Monopoly of the market over there belongs to Philip Morris, who have three national subsidiaries. After the tax hike, the company increased its prices disproportionately. “There was a brutal increase in the factory gate price. The industry applied prices that were much higher than the increase in taxes. At the same time, they were crying out that the illegal trade was going to increase.”

The story gets even more interesting. “In 2019, when a study was made to assess the growth of the illicit cigarette trade in Paraguay, guess which were the most commonly found products? Most of them were coming from Philip Morris subsidiaries in other countries. This means that the company itself was allowing packs of Marlboro to come in from Mexico and Colombia, while at the same time they increased their prices in Ecuador”, explains Iglesias.

The Canadian case is another example of a fishy story, which according to the economist holds many similarities to something which happened in Brazil in the 1990s. In this case, both BAT Brasil and Philip Morris started to export cigarettes to Paraguay, paying no taxes for this, at a much higher volume than that country’s consumption – and in the meantime, increasing their prices in Brazil. “With the price increase here, demand tended to fall. What did they do to keep up the demand? They introduced smuggled cigarettes”, he says, and explains: “They would send cigarettes to Paraguay, and these cigarettes then returned to Brazil without paying any taxes”.

Things eventually fell apart for the major tobacco companies. When, in 1998, the Brazilian government levied a 150% tax charge on cigarette exports to Latin America, the business no longer made sense for them. But it was too late: several factories had sprung up in Paraguay that continued to send their smuggled products to Brazil.

Similarly, says Iglesias, in Canada companies started to export cigarettes to locations where it was difficult to control the movement of cigarettes: New York State, in the Northeastern part of the U.S., near Indian reservations. “And so, just as Paraguay started to have clandestine factories, the same happened in these Indian reservations, who started to manufacture illegal cigarettes.” In other words, the major companies were the ones who created the business. “They complain about the illegality they invented.”

Data quality

There is something here which draws the attention when we compare the documents sent to the WG: the disparity between the data on contraband.

ETCO uses data from Ibope (now Ipec) as a base and says that the illegal market has grown substantially since 2011, surpassing the legal Market for the first time in 2018. In that year, it is said to have taken a 54% share of the Brazilian market (the percentage is said to have dropped to 49% in 2021). Philip Morris, in turn, calculated an average between the results of two surveys: one by Ibope/Ipec and the Empty Pack Survey, conducted by MSIntelligence – and concluded that illegal cigarettes took a 38.2% share of the market.

But data from the National Cancer Institute (Inca), point towards a slightly lower percentage. Based on information from the Internal Revenue Service, Ministry of Health and the Brazilian Institute of Geography and Statistics (IBGE), Inca researchers identified that the illegal cigarette participation in the Brazilian market reached 42.8% in 2016, but then dropped and stood at 31.4% in 2018. “Our data is obtained through public methodologies. The methodology of the surveys used by ETCO never appears”, Iglesias compares.

As we have shown here, the arguments in favor of segmenting the cigarette market and reducing the minimum price were taken apart during the Working Group discussions, especially based on the presentation by the Internal Revenue Service and Inca.

But one of the sources, somebody who took part in the WG and wished to remain anonymous, told Joio that at first it was easy to get caught up in the proposed changes to taxation. “If you don’t have the official data, you start to find the idea very interesting. You hear that reducing the minimum price of cigarettes will improve the problem with smuggling and increase tax revenue. Data is provided by Ibope, a company that was quite renowned in Brazil, and if you do a Google search, you will see a lot of data matching up. Because it’s data that is usually echoed”, the person says.

Hence the importance of the Internal Revenue Service and Inca having come in with a magnifying glass. The Internal Revenue Office, specifically, has shown that any tax reduction would not be enough to place Brazilian cigarettes at the same price level as Paraguayan cigarettes. That’s because they have a very large leeway to always remain cheaper. “When the details were presented, the technical information on tax collection, imports and exports, the argument started to break down. The numbers didn’t add up, you see?”, the source explains. It wasn’t a solution, but a trap.